3:26:13 PM | 11/6/2025

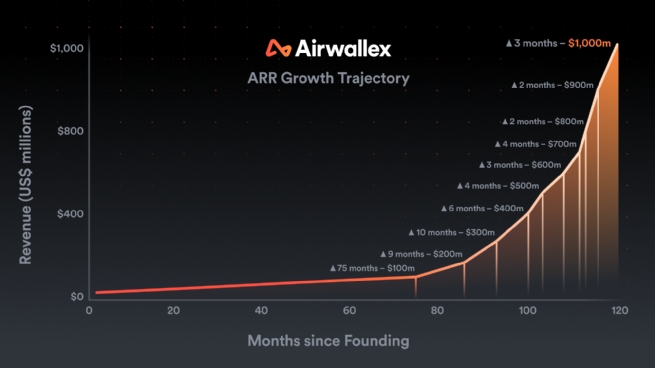

Airwallex, a leading global financial platform for modern businesses, announced it has surpassed US$1 billion in annualized run rate revenue (ARR). With a current growth rate of around 90% year-on-year, Airwallex is projecting to double its ARR to US$2 billion within the next 12 months.

Revenue from Southeast Asia, which includes Vietnam, doubled (108%) in FY25Q3 while transaction volume increased by 94% as compared to the same period last year.

Mr. Jack Zhang, Co-Founder and CEO of Airwallex |

Mr. Jack Zhang, Co-Founder and CEO of Airwallex said, “This milestone is tangible proof that global businesses are moving past the constraints of an outdated financial system. It represents the trust that our customers place in us and our ability to address the needs of modern businesses as they scale across markets, currencies, and borders.”

Airwallex’s path to $1 billion ARR

Achieving US$1 billion ARR marks a major acceleration in Airwallex’s growth trajectory. The company took nine years to reach its first US$500 million ARR, while the next US$500 million was achieved in just over a year. This acceleration reflects both growing customer adoption and the rise of global-first companies.

The number of customers using multiple Airwallex products has doubled since last year, demonstrating a strong and growing product market fit. Customers typically partner with Airwallex to solve a single need, before extending their usage across markets and product suites as they scale. The organic growth reflects deep trust and the value of a single platform that can grow with them, wherever they go.

Another contributing factor is a new generation of “born-global” businesses are accelerating economic interconnection. High-growth companies in AI and SaaS are launching into multiple markets from day one, selling, hiring, and transacting globally by design, with Airwallex uniquely positioned to power that shift.

Getting to US$2 billion and beyond

Airwallex has outlined several levers to fuel continued acceleration:

Source: Vietnam Business Forum