10:34:23 AM | 9/22/2025

Accessible across multiple platforms, the three electronic tax handbooks are also integrated with AI to offer practical Q&A interaction, allowing users to quickly and conveniently reference and apply tax policies and administrative procedures.

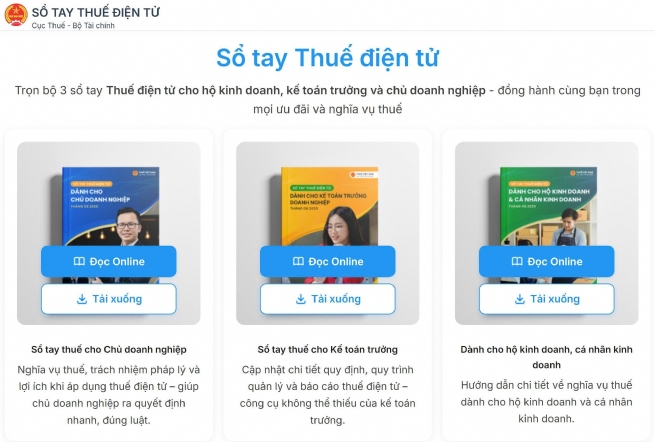

The Department of Taxation (Ministry of Finance) has just released a set of three electronic tax handbooks, including: the Electronic Tax Handbook for Business Owners; the Electronic Tax Handbook for Chief Accountants; and the Electronic Tax Handbook for Individual Business Owners, available at: https://hotronnt.gdt.gov.vn/so-tay-thue-dien-tu/

This product is part of the continued implementation of Resolution No. 57-NQ/TW of the Politburo on breakthroughs in science, technology, innovation, and national digital transformation.

The three digital tax handbooks are accessible across platforms, featuring links to legal documents, forms, videos, and infographics, serving as a practical guide for businesses and households.

The launch of these three electronic tax handbooks marks an important step in the tax sector’s modernization journey, reflecting the determination of the tax authorities to: accompany, support, and facilitate taxpayers; ensure transparency, openness, and accessibility of tax policies and laws; encourage voluntary compliance; and contribute to building a healthy and sustainable business environment.

“With the launch of the three electronic tax handbooks, the tax sector believes that this will be a knowledge bridge bringing tax policies closer to businesses, chief accountants, and household businesses, while affirming the determination of the tax sector to innovate, reform, and integrate,” said Nguyen Thi Lan Anh, Head of the Legal Department (Department of Taxation).

By Thanh Nam, Vietnam Business Forum