11:10:31 AM | 2/25/2025

In 2024, China surpassed South Korea, Japan and Singapore to lead in new investment projects in Vietnam. Beyond the rise in quantity, the quality of Chinese-funded projects also saw significant improvement. Investment advisor Ngo Nghi Cuong, CEO of C+ Consult., highlighted this in an interview with us.

Mr. Ngo Nghi Cuong addresses the Vietnam-China Trade and Investment Forum held in Ho Chi Minh City, November 28, 2024

Currently, Chinese FDI leads project numbers in Vietnam and is moving toward the top in value. What do you think about this trend?

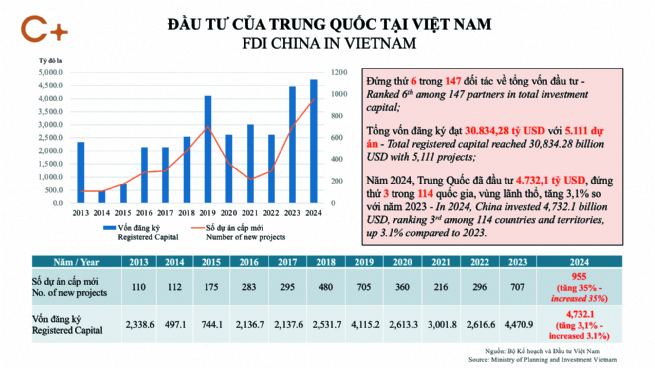

According to data recently released by the Ministry of Planning and Investment, in 2024, Chinese FDI ranked first in newly licensed projects in Vietnam and third in newly registered investment value. By year-end, Chinese FDI projects held 6th position, but when including Hong Kong (China), the ranking rose to 4th, trailing only South Korea, Singapore and Japan.

In fact, in the past two years, phenomenally, Chinese overseas investment often flowed indirectly through third countries rather than directly to destination markets. If this capital is accounted for, Chinese FDI is steadily moving toward a top-ranking position in the near future.

Chinese overseas corporate investment continued to grow in 2024. Specifically, in the first 10 months of 2024, China's overseas investment approximated US$135.9 billion, 10.9% more than in the same period of 2023 (according to data from the Ministry of Commerce of China - MOFCOM). Vietnam was among the top recipients of this capital flow. In 2024, the country licensed 955 projects with a newly registered capital of US$2.84 billion. Compared to 10 years ago, China's FDI increased 8.5 times in both projects and registered capital.

This trend will continue in 2025. According to a report released by the China Council for the Promotion of International Trade on December 27, 2024, more than 80% of surveyed companies said they would maintain operations or expand their overseas investment.

What factors have driven the significant shift in Chinese FDI toward large-scale, high-tech projects?

We have seen some Chinese FDI projects worth hundreds of millions of US dollars registering to invest in manufacturing semiconductors, photovoltaic cells, electronic components, household appliances and consumer goods. This is a higher quality capital flow than the previous labor-intensive one.

However, in my opinion, this so-called "quality" improvement does not necessarily mean the adoption of cutting-edge technologies. While these projects may introduce advanced fields to Vietnam, they often involve older technologies for Chinese companies expanding abroad. China remains far ahead in many sectors, including processing and manufacturing - particularly in electric vehicles (EVs) and components, rechargeable batteries, automation, biochemicals, new materials, clean energy, high-speed rail construction and AI applications.

Chinese companies also have invested significantly in research and development (R&D) which is currently enjoying tax incentives and special subsidy policies from the Government.

They do not transfer modern technologies when investing abroad. Usually, they transfer 1-2 older generation machines to invested countries. In addition to security and copyright factors, language and high-quality human resources are major barriers that cannot be overcome.

But overall, the recent shift in quantity and quality of Chinese FDI capital flows is a positive signal.

So, which sectors, industries and locations in Vietnam will see the strongest influx of Chinese FDI?

Since the original cause of the investment wave into Vietnam is to diversify risks from the import tariff policy of the United States, this wave is mostly channeled into manufacturing exports to the North American market such as EV components, electronic components, mechanical products, interiors and exteriors, and household appliances.

In 2025, more capital will be channeled into construction, transport infrastructure, logistics and retail sectors due to the demands from their own supply chains and a deeper understanding of Vietnamese market demand. While many businesses in these sectors merely explored opportunities in 2024 to serve existing customers, they are likely to shift toward more ambitious investments as they recognize Vietnam’s strong growth potential.

Chinese business culture is communal and close-knit. They easily choose an investment location just from a recommendation made by a business partner which has already invested there. This partly explains why some provinces and cities have recently attracted a lot of Chinese FDI capital such as Bac Ninh, Bac Giang, Hai Phong, Binh Duong, Dong Nai and Ba Ria - Vung Tau.

Of course, Chinese investors are also interested in transport infrastructure connections, especially international seaports, labor costs and initial investment costs, as well as the sectoral ecosystem when they consider choosing an investment location. Localities need to have their own strategies based on local advantages to entice Chinese FDI capital.

What factors do you prioritize when advising Chinese investors in Vietnam, and what challenges need to be addressed?

We consistently emphasize three key factors: Alignment with Vietnam's economic development strategy, close collaboration with domestic enterprises, and a long-term investment plan.

The first factor is understanding Vietnam’s economic development outlook for the next five years and beyond, a necessary aspect for Chinese investors. Vietnam is committed to building a green and sustainable economy, yet Chinese FDI has shown limited interest in energy transition, digital transformation and other sustainability-driven projects. In the long run, Chinese capital may become less competitive compared to investment flows aligned with Vietnam’s sustainable development goals.

| C+ Consult. offers three main service areas: market entry, site location advisory, and project implementation consulting. Within each area, we provide both standard and customized packages to meet our clients' different needs. Our specialized expertise, dedicated service, and diverse team of consultants enable us to maximize the efficiency of our clients' investments in Vietnam. |

The second factor is fostering close collaboration with domestic enterprises to leverage their expertise in the local market and supply chains. Initially, Chinese firms may rely on their own supply networks when entering Vietnam, but this approach can prove inefficient and costly over time. Conversely, local businesses may face initial challenges in integrating into Chinese-led supply chains. However, as they gain a clearer understanding of demand and secure stable orders, domestic manufacturers will invest in upgrading their capabilities to meet these needs.

The third factor is a long-term investment plan. While overseas investment is influenced by geopolitical shifts, supply chain realignments and economic cycles, a long-term commitment in Vietnam enhances the appeal of investment projects to local authorities, business partners and workers. We can see that Japanese enterprises rarely face recruitment challenges, largely due to their reputation for stability and long-term presence. A commitment to sustained investment not only fosters trust but also strengthens the investor’s brand and market position in Vietnam.

Thank you very much!

By Duy Anh, Vietnam Business Forum