11:16:58 AM | 10/26/2025

As of the end of September, Vietnam’s total import-export turnover reached US$680.66 billion, up 17.66% year-on-year. Exports rose 16% to US$348.74 billion, exceeding the 12% target, while imports grew 18.8% to US$331.92 billion, resulting in a trade surplus of US$16.82 billion for the first nine months.

According to Le Hoang Tai, Deputy Director General of the Trade Promotion Agency (Ministry of Industry and Trade), export growth amid global economic uncertainty reflects the strong efforts of the business community and the effectiveness of government directives. However, he cautioned that to meet the export target of the year, Vietnam must navigate significant internal and external challenges.

Geopolitical instability and armed conflicts are disrupting supply chains, pushing up costs for logistics, maritime transport, and insurance. Volatile oil prices, input materials, and exchange rates are increasing risks and putting pressure on profit margins. Strategic competition among major economies including the U.S., China, EU, Japan, and India is intensifying, covering not only trade but also technology, finance, energy, and sustainability standards. At the same time, protectionist measures, industrial subsidies, export controls on critical technologies, and tighter environmental, labor, and technical requirements are being enforced.

Next-generation non-tariff barriers such as ESG standards (Environmental, Social and Governance), C-TPAT (Customs-Trade Partnership Against Terrorism), and anti-circumvention trade defense regulations are becoming “entry tickets” to demanding markets. Failure to meet these standards can exclude suppliers from the outset.

With a trade deficit of over US$100 billion with China, Vietnam risks becoming a target of trade defense investigations. If the U.S. imposes tariffs of up to 60% on Chinese goods, Vietnam could be indirectly affected if its exports are suspected of being rerouted to bypass these tariffs. As “transshipment” remains undefined, businesses must ensure transparency in supply chains and product origin to avoid passive exposure. In addition, potential U.S. retaliatory tariffs of 20-40% would add further pressure on exports.

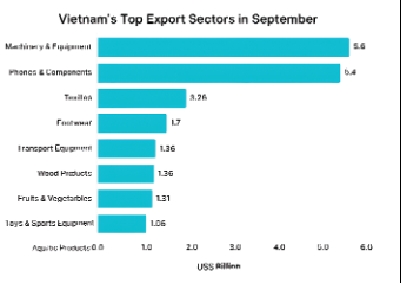

In September, Vietnam’s total import-export turnover reached US$82.49 billion, with exports at US$42.67 billion, down 1.7% from August but still up 24.77% year-on-year. Top export sectors included machinery and equipment at US$5.6 billion (up 8.1%), phones and components at US$5.4 billion (down 5.6%), textiles at US$3.26 billion (down 15.6%), footwear at US$1.7 billion (down 14.4%), transport equipment at US$1.38 billion (down 6.7%), wood products at US$1.36 billion (down 6.9%), fruits and vegetables at US$1.31 billion (up 38%), toys and sports equipment at US$1.06 billion (down 1.5%), and aquatic products at US$1.01 billion (down 5.6%).

Since joining the WTO in 2007, Vietnam has used investment inflows to boost exports. Yet the growth model, which relies heavily on processing and assembly at the lower end of global value chains, is increasingly revealing its weaknesses. The FDI sector continues to dominate, contributing 79.2% of total export turnover in the first half of September.

Le Hoang Tai emphasized that the share of high value-added, technology-intensive, and innovative products in Vietnam’s exports is still limited. As a result, profit margins remain low, exposure to external shocks is high, and most added value in the supply chain is captured outside Vietnam.

Meanwhile, small and medium-sized enterprises (SMEs), which make up the majority, face limitations in capital, technology, and management capacity. Compliance with international standards on food safety, traceability, and environmental requirements remains a significant hurdle, leaving many SMEs excluded from initial supplier selection in markets like the U.S. and EU. In addition, the use of next-generation free trade agreements (FTAs) such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the EU-Vietnam Free Trade Agreement (EVFTA) remains below potential, restricting opportunities for broader market expansion.

Vietnam’s footwear sector posts positive growth but still faces significant challenges

To meet year-end targets, Vietnam requires a coordinated strategy addressing both supply and demand, along with effective export organization. Economic diplomacy will be key to opening markets in the Middle East and Gulf and speeding up negotiations with partners like Canada to establish flexible cumulative sourcing mechanisms. Additionally, Resolutions 66 and 68/2025 are expected to resolve legal bottlenecks, enabling businesses to overcome institutional barriers and gain momentum.

According to the Ministry of Industry and Trade, Vietnam’s breakthrough export strategy now rests on three pillars: market and product diversification, advancing green transformation, and raising localization rates. The focus is gradually reducing dependence on traditional markets such as the U.S. and EU, while leveraging geographic advantages and FTAs to expand into new destinations such as the Middle East, Africa, and niche Halal markets.

In traditional industries such as textiles, footwear, wood, and agriculture, the orientation is to strengthen deep processing and apply green technologies to meet ESG standards, turning technical barriers into competitive advantages. In high-tech sectors, the goal is to increase localization and ensure product origin transparency, helping enterprises cope with trade defense measures.

Heavy dependence on the FDI sector highlights the need for domestic enterprises to strengthen capabilities and integrate more deeply into global supply chains. Experience from past integration processes, ranging from the Vietnam-U.S. Trade Agreement to next-generation FTAs, shows that export growth has always been accompanied by institutional reform and enhanced production capacity. In the current context, Vietnam’s export strategy must uphold that approach by promoting green transformation and fostering technological advancement, thereby raising the competitiveness of Vietnamese businesses.

By Huong Ly, Vietnam Business Forum