9:39:53 AM | 1/27/2026

In 2025, Vietnam’s total trade value surpassed US$930 billion for the first time, increasing 18.2% compared with 2024. This result underscored the strength of an open economy and created a foundation for Vietnam to move with confidence from scale expansion toward deeper value creation.

Impressive figures

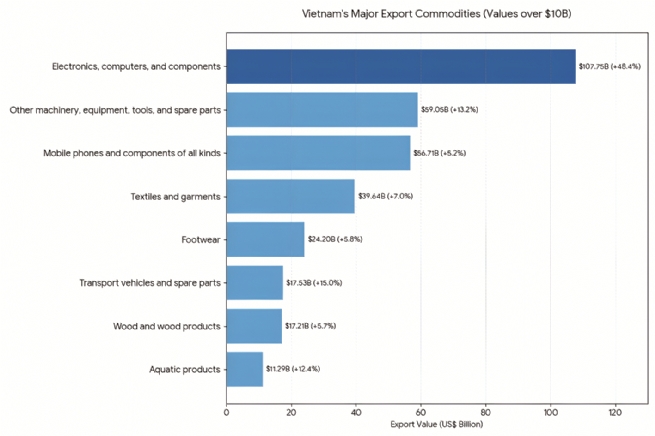

In 2025, Vietnam’s exports reached US$475.04 billion, an increase of 17.0% year on year. During the year, 36 product categories posted export values of more than US$1 billion, accounting for 94.0% of total export turnover, including eight categories with exports exceeding US$10 billion, which together made up 70.2%. Imports totaled US$455.01 billion, up 19.4% from the previous year.

Deputy Minister of Industry and Trade Phan Thi Thang said export momentum was driven by balanced growth across many key product groups, particularly electronics, computers, and components, alongside a clear recovery in agriculture, forestry, and fisheries, including fruit and vegetables, durian, and lobster. Textiles and garments, wood, and wood products also recorded positive gains, reflecting improving global demand and the ability of Vietnamese enterprises to capture market opportunities.

Dr. Le Duy Binh, Director of Economica Vietnam, said the export record was supported by the recovery of major markets such as the United States (U.S.), the EU, and Japan, driven by economic recovery measures and looser monetary policies. Peak shopping seasons in the final months of the year generated strong demand for Vietnamese strengths, including textiles and garments, footwear, furniture, electronics, food, and agricultural and forestry products.

According to Nguyen Bich Lam, former Director General of the National Statistics Office, as of 2025, Vietnam’s merchandise trade balance had recorded consecutive surpluses for 10 years. However, during the 2023-2025 period, while total import-export turnover grew rapidly, the trade surplus ratio declined from 4.12% in 2023 to 3.17% in 2024 and 2.3% in 2025. Lam said this trend reflected international trade growth outpacing the economy’s ability to accumulate net value, reducing the contribution of imports and exports to GDP scale and growth over the past three years.

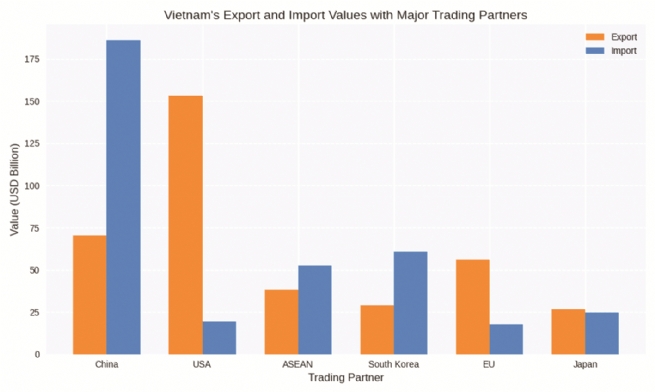

The FDI sector continued to serve as a pillar, with projected turnover of US$663 billion, accounting for 72% of the total. According to Tran Thanh Hai, Deputy Director of the Agency of Foreign Trade, exports still relied heavily on FDI, while domestic enterprises had yet to engage deeply in higher-value stages and remained dependent on imported inputs. Capabilities in design, marketing, and compliance with international and green standards remained limited, leaving production and exports vulnerable.

At present, the U.S. was the largest export market, accounting for over 32%, while China led imports at around 40%. This reality showed risks of dependence on two traditional markets. In addition, FDI enterprises accounted for 70-75% of export turnover, but value added retained in Vietnam remained low, mainly concentrated in assembly, while higher-value stages such as branding, marketing, and supply chains were incomplete. The trade balance was also skewed, with a surplus with the U.S. and a deficit with China.

Key to sustainable trade development

The Ministry of Industry and Trade set an export growth target of over 8% for 2026, with a strategy centered on greener production and digital transformation. To move beyond the low-value-added processing model, experts agreed that Vietnam’s future trade development must be built on three pillars: the Green Economy, the Digital Economy, and the Knowledge Economy.

Sustaining the US$920 billion trade milestone in 2025 depended on stronger supporting industries; to keep exports durable, Vietnamese enterprises needed to progressively secure greater autonomy over input supply. Dr. Nguyen Thuong Lang of the National Economics University said export growth and FDI inflows were driven by several factors, including domestic reforms to the investment environment, legal procedures, and incentive policies; FTAs and stable diplomatic relations; competitive labor costs; and the relative depreciation of the Vietnamese dong, which improved the attractiveness of Vietnamese products in international markets. Many foreign investors therefore selected Vietnam as a long-term destination, using a stable production base to expand operations and transfer projects as the economy accelerated.

Regarding the fact that the FDI sector still accounted for a large share of exports, limiting domestic value retention, with most profits accruing to parent corporations while Vietnam benefited mainly from wages, taxes, and infrastructure, Dr. Lang said Vietnam needed to encourage domestic enterprises to engage more deeply in FDI projects through capital contributions, joint ventures, or equitization to learn technology, management skills, and international market experience.

According to Tran Thanh Hai, optimizing logistics, promoting cross-border e-commerce, and applying digital technologies were prerequisites for entering demanding markets. Information transparency through blockchain, identification codes, traceability, and green standards had become “passports” for Vietnamese goods entering the U.S. and Europe.

According to Nguyen Bich Lam, restructuring international merchandise trade required six core solutions: renew evaluation indicators by shifting the focus from turnover growth to higher value added, efficiency, and sustainability, while incorporating green, digital, and knowledge-based economic metrics; develop the domestic economic sector to enable enterprises to engage more deeply in value chains through green transformation, digitalization, and higher knowledge content; accelerate the development of supporting and foundational industries to reduce import dependence and form clusters linking green production, digital governance, and technological innovation; prioritize export industries based on knowledge, R&D, branding, intellectual property, and international standards; modernize trade infrastructure, logistics, and supply chains in a green-digital direction to reduce costs and increase transparency; and proactively adapt to new rules by integrating green, digital, and knowledge economies into FTA strategies and market expansion.

By Huong Ly, Vietnam Business Forum