10:35:03 AM | 1/28/2026

In 2025, despite fluctuations arising from global trade and geopolitical developments, foreign direct investment (FDI) inflows into Vietnam continued to show positive momentum. Many large-scale, high-technology projects were implemented, reinforcing the attractiveness of the investment environment, strengthening foreign investor confidence, and opening up opportunities for sustainable economic growth in the years ahead.

Growth in both scale and quality

According to data from the National Statistics Office under the Ministry of Finance, total registered foreign investment in Vietnam reached US$38.42 billion as of December 31, 2025, up 0.5% year on year. Notably, realized foreign direct investment for the full year was estimated at US$27.62 billion, an increase of 9%, marking the highest level recorded during the 2021-2025 period.

In 2025, Vietnam licensed 4,054 new FDI projects with total registered capital of US$17.32 billion. Of this amount, the processing and manufacturing sector remained the largest investment destination, attracting US$9.80 billion and accounting for 56.5% of newly registered capital. Real estate ranked second with US$3.67 billion, or 21.2%, while the remaining sectors accounted for US$3.85 billion.

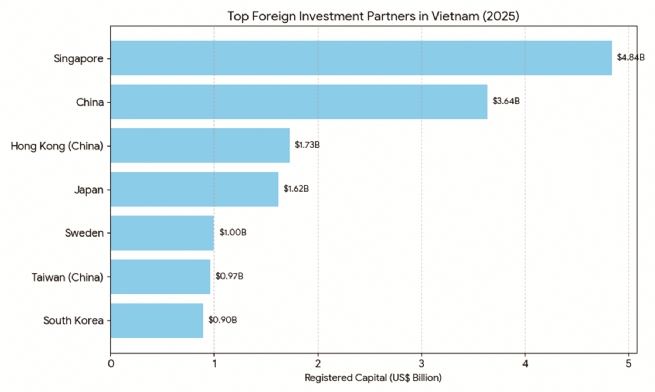

In terms of investment partners, Singapore led with registered capital of US$4.84 billion, accounting for 27.9%. This was followed by China with US$3.64 billion (21%), Hong Kong (China) with US$1.73 billion (10%), Japan with US$1.62 billion (9.4%), and Sweden with US$1.0 billion (5.8%). Taiwan (China) and South Korea followed, with registered capital of US$965.8 million and US$895.9 million, respectively.

Alongside newly registered capital, adjusted capital saw 1,404 previously licensed projects registering additional investment of US$14.07 billion, up 0.8% from the previous year.

According to the National Statistics Office, a key positive feature of Vietnam’s FDI landscape in 2025 was the sharp rise in disbursed capital, which increased by 9% year on year to an estimated US$27.62 billion, the highest level of realized FDI in the past five years. Of this total, the processing and manufacturing sector accounted for US$22.88 billion, or 82.8% of realized FDI, followed by real estate activities with US$1.93 billion, or 7.0%. Electricity, gas, hot water, steam, and air conditioning supply attracted US$914.9 million, equivalent to 3.3% of the total.

Hanoi was among the leading localities in attracting FDI. Major projects included those by Gamuda Group (Malaysia), such as the Yen So Park Development Project, the C2-Gamuda Gardens New Urban Area Project, the Nam Thang Long New Urban Area Project, and the Le Trong Tan New Urban Area - ParkCity Hanoi Project.

Bac Ninh, long regarded as an FDI hub in northern Vietnam, continued to attract large-scale projects from major corporations such as Samsung, Canon, and Goertek.

In Dong Nai, the province recorded strong FDI inflows in 2025, licensing several major projects, including the Mapletree Logistics Park Tam An 1 Project by Singapore’s Saffron Logistics Asset Holdings PTE. LTD with registered investment of US$101.1 million; an investment expansion by Pingfu Home Products Co., Ltd., a U.S.-invested enterprise, which added more than US$37.6 million, raising total investment to US$80 million at Minh Hung-Sikico Industrial Park; and a manufacturing project by Midwest Pets Vietnam Co., Ltd. of Singapore, with investment of US$27.8 million at Becamex-Binh Phuoc Industrial Park.

These results reinforced the confidence of foreign investors in Vietnam’s investment environment and the economy’s capacity to absorb capital.

Strong investment inflows in Vietnam in 2025 reinforce investor confidence and support sustainable economic growth

Room for growth in 2026

In 2026, FDI inflows into Vietnam are expected to continue expanding as a series of major infrastructure projects come into operation. Hanoi is accelerating the development of synchronized industrial infrastructure, creating an increasingly attractive investment and business environment. The city’s plan to develop a multi-center investment space linked with new growth poles such as Dong Anh-Soc Son-Me Linh for industry and logistics, Gia Lam-Long Bien for commerce and services, and Ha Dong-Hoai Duc for urban development, finance, and technology is expected to form a more balanced investment structure.

For Bac Ninh, after many years of industrial development, the province has been assessed as a major base for the electronics industry and a market with strong potential for semiconductors. To anticipate investment shifts, the province has planned specialized industrial parks with hundreds of hectares of cleared land and modern, synchronized infrastructure. With a large land fund and the Gia Binh Airport under development, Bac Ninh is well positioned to attract both domestic and foreign investment.

Another locality, Phu Tho, has set a target to attract more than US$1.1 billion in FDI in 2026, with a focus on project quality, efficiency, and sustainability. The province is addressing infrastructure bottlenecks, site clearance, high-quality human resource development, and improvements to the investment and business environment. Public investment is being deployed in a focused and prioritized manner to serve as seed capital for large-scale, high-technology FDI projects.

In the southern region, Long Thanh International Airport welcomed its first flight on December 19, 2025 and is scheduled to officially begin commercial operations in the first half of 2026. In June 2026, Phase I of the 76.3-kilometer Ho Chi Minh City Ring Road 3 is expected to open to traffic, with four expressway lanes and parallel service roads. Once operational, the project will connect industrial parks and seaports in Ho Chi Minh City, Dong Nai, and Tay Ninh, forming an industrial corridor that links seaports, reduces logistics time and costs, and creates new growth momentum for the Southern Key Economic Region.

In addition, the Ben Luc-Long Thanh interregional expressway is expected to be fully completed in September 2026, significantly shortening travel distances from the Mekong Delta to Cai Mep-Thi Vai Port and Long Thanh International Airport. The Cai Mep Ha Free Trade Zone project in Ho Chi Minh City and a free trade zone in Dong Nai are currently under investment preparation. At the same time, the development of logistics zones and next-generation industrial parks is expected to enhance Vietnam’s attractiveness to strong FDI inflows and strategic investors.

The outlook for 2026 remains positive, with forecasts indicating continued growth in FDI flows, concentrated in green and digital sectors, prioritizing high-technology projects with high value added, lower labor intensity, and environmental compatibility.

At the same time, regional competition has become increasingly intense, particularly from India, Malaysia, and Indonesia, which are advancing tax incentives and developing specialized industrial parks. This requires Vietnam to continue shifting its focus from attracting large volumes of capital to attracting high-quality investment, with priority given to core technologies, innovation, value chain linkages, and higher localization rates.

At a forum on improving policies to attract a new generation of investment into industrial parks, held in late November 2025, Hoang Quang Phong, Vice President of the Vietnam Chamber of Commerce and Industry (VCCI), said that Vietnam is facing a historic opportunity to attract high-quality capital flows in high-technology and innovation sectors. Nguyen Duc Hien, Deputy Chairman of the Central Commission for Policy and Strategy, also noted that Vietnam is at a critical juncture to transform into a manufacturing hub linked with innovation and sustainable development in the region. Completing policies to attract a new generation of FDI will play a key role in turning this objective into reality.

Going forward, Vietnam needs to build a comprehensive ecosystem to support high-quality FDI, including digital infrastructure, clean energy, smart logistics, and transparent administrative services. Next-generation high-tech zones should be planned with integrated R&D, production, and training functions, serving not only as manufacturing bases but also as centers of innovation.

At the same time, many investors remain cautious and are closely observing the impact of the two-tier local government model. As a result, a strong focus on business efficiency and the rapid strengthening of investor confidence will be essential.

By Thu Ha, Vietnam Business Forum