9:37:18 AM | 2/5/2026

Closing 2025 with notable milestones and record figures, Vietnam’s stock market has entered 2026, a pivotal year marking the start of the most ambitious policy cycle in its history. With a GDP growth target of 10% and a clear commitment to achieving market upgrade status, this period is seeing informed capital concentrate on re-rating prospects and institutional reform.

Vietnam’s stock market posted good performance in 2025

2025: Index gains amid sharp divergence

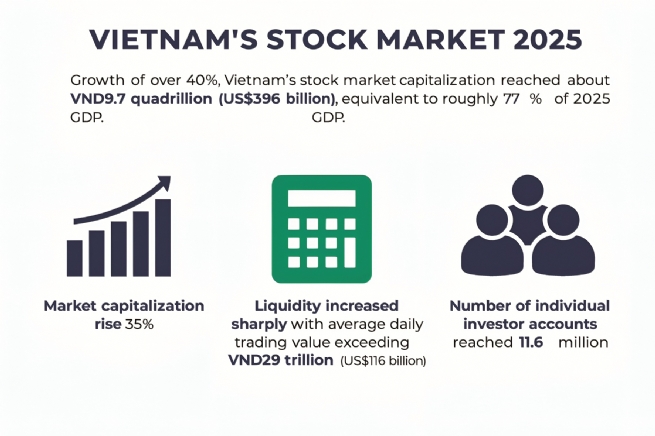

Looking back at fiscal year 2025, based purely on technical indicators, this period marked the strongest phase in the 25-year history of Vietnam’s stock market. The VN-Index at one point surpassed 1,800 points. Equity market capitalization expanded by 35%, while liquidity surged, with average trading value exceeding VND29 trillion (US$1.16 billion) per session, up more than 40% from the previous year. Notably, the number of individual investor accounts reached 11.6 million, meeting ahead of schedule the targets set under the market development strategy through 2030.

However, Founder of FinPeace JSC Nguyen Tuan Anh commented: “Despite strong index gains, this was a year in which even balanced portfolios delivered weak results. Focusing on leading stocks was challenging, while broad allocation clearly dragged down performance.” He added that the global macro environment, particularly shocks from U.S. trade policy such as the “Liberation Day Tariff” event, increased market difficulty.

Gains were mainly concentrated in core stocks, leading to greater capital divergence. “If stocks with significant influence from the Vingroup group are excluded, the market’s growth picture becomes much less positive. Most remaining stocks rose by only about 6%, and if major banking stocks are also excluded, the actual increase narrowed to around 3-5%,” said Nguyen Thanh Trung, CEO of Finsuccess Investment JSC.

This pattern was reinforced by data from KIS Securities, showing that more than 62% of stocks on the HSX underwent corrections of 10-20% even as the VN-Index stayed near peak levels.

Institutional reform and public investment as catalysts

Entering 2026, Vietnam’s stock market is being supported by constructive macroeconomic forces. This marks the first year of the five-year socio-economic development plan (2026-2030), which sets a GDP growth target of 10%. The key driver in this phase is the combined effect of public investment policy and reform of state-owned enterprises.

With total budgeted public capital for 2026 projected at VND1,080 trillion (US$43.2 billion), public investment has become a central engine of economic growth. Prime Minister Pham Minh Chinh called for ending fragmented investment and concentrating resources on major national projects such as Long Thanh Airport, high-speed rail, and the North-South expressway system. This creates direct growth potential for infrastructure construction, building materials, and energy companies. Stocks linked to public investment and power generation are positioned to benefit from the large volume of work associated with these priority projects.

At the same time, Politburo Resolution 79-NQ/TW on development of the public economic sector is viewed as a potential growth catalyst for state-owned enterprises, triggering a re-rating wave among large-cap stocks. Nguyen The Minh, Director of Research at Yuanta Securities Vietnam, assessed that Resolution 79 has fundamentally reshaped capital management thinking. Resources will be concentrated on strategic sectors such as defense, energy, and finance to build regionally competitive conglomerates, while divestment in commercial enterprises will be accelerated to below 50%.

This qualitative shift is transforming the State Capital Investment Corporation (SCIC) from a capital-holding entity into a professional capital investment institution. In the first week of 2026 alone, the market recorded strong rallies among stocks with public ownership, including PetroVietnam Gas (GAS), up 34.12%, Binh Son Refining and Petrochemical (BSR), up 22.36%, and major public banks such as Vietcombank (VCB), BIDV (BID), and VietinBank (CTG). MB Securities (MBS) assessed that the divestment roadmap at public enterprises will become a new focal point for capital flows throughout 2026.

Nevertheless, the global backdrop in 2026 continues to carry risks from geopolitical tensions and a slowdown in global growth. VNDirect Securities Corporation warned that pressure on supply chains remains, requiring flexible coordination between monetary and fiscal policy. Even so, easing global inflation and the U.S. Federal Reserve’s entry into an interest rate cut cycle are expected to ease exchange-rate pressure and support the return of foreign capital to Vietnam’s market following heavy net selling in early 2025.

Focus on market upgrade and infrastructure investment

At the opening bell ceremony for the first trading session of 2026, Minister of Finance Nguyen Van Thang delivered a clear message: “2026 marks the beginning of a new development era for the country. Vietnam’s stock market must demonstrate determination to move forward.” He directed the securities sector to concentrate on seven priority tasks, with the most pressing being completion of the legal framework and decisive implementation of the market upgrade roadmap.

A central objective is official reclassification by FTSE Russell from frontier market to secondary emerging market status in September 2026. In its September 2025 review, FTSE Russell confirmed that Vietnam met all required criteria. The upgrade is not merely symbolic; it opens the door to inflows of billions of U.S. dollars from global investment funds. To secure this outcome, Minister Nguyen Van Thang underscored the need to address constraints in market access for global brokerage firms and to accelerate digital transformation and modernization of trading infrastructure.

From the operating side, Vu Thi Thuy Nga, CEO of the Hanoi Stock Exchange (HNX), said that 2026 will see the launch of several new products and market segments. HNX will study plans to establish a capital market platform for innovative startups and, notably, to develop a pilot carbon trading system, expected to begin operations by the end of 2026.

In addition, the KRX system, operating stably since May 2025, has laid the groundwork for new practices such as same-day trading (T+0) and covered short selling in the future. The anticipated migration of several banks from UPCoM to HoSE, including KienlongBank, BVBank, and VietBank, is also expected to generate fresh appeal and improve the quality of listed securities.

2026 is not merely a continuation of 2025, but a qualitative turning point for Vietnam’s stock market, moving toward deeper development driven by public investment, enterprise reform, and international standards.

By Huong Ly, Vietnam Business Forum